Credit Card Processing

AIM: To create a system to perform the credit card processing

(I)Procedure:Problem statement

Credit card processing through offline involves the merchant collecting order information (including credit card numbers), storing this in a database on your site, and entering it using their on-site merchant credit card processing system. Takes time to manually enter credit card information for each order. This solution creates the following cons:

- Insecure: There is a possibility that a skilled hacker could break into the database and steal an entire list of credit card numbers, thereby damaging the merchant’s reputation with current clients.

- Higher risk of customer chargebacks: With no signature, there is a higher risk of customer chargebacks.

- Higher risk of fraud: For using stolen credit cards.

- Lack of trust: Many discerning online shoppers will not give their credit card to an “untrusted” online merchant (you may want to consider being part of the Better Business Bureau or similar organization to add credibility).

So there is a need for online and trusted credit card processing.

(II)Software Requirement Specification

Introduction

A credit card is a small plastic card issued to users as a system of payment. It allows its holder to buy goods and services based on the holder’s promise to pay for these goods and services. The issuer of the card creates a revolving account and grants a line of credit to the consumer (or the user) from which the user can borrow money for payment to a merchant or as a cash advance to the user.

When a purchase is made, the merchant swipes the card. The information goes to a gateway processor, which either accepts or rejects the transaction. If it is accepted, the transaction is held until the end of the business day. The merchant then reenters the transaction via the gateway processor, the data is logged, and the debt is transferred to the account. The use of an ATM for cash advance is a similar process.

If you are selling to consumers, merchant services will allow you to expand your customer base and provide a more convenient method of payment than cash or checks. And if you are interested in selling over the Internet, accepting credit card processing is a must. Accepting credit cards allows funds to be transferred to your bank account in less than a week. This can be a welcome relief for businesses that experience a tight cash flow.

The two purchase options for Credit Card Processing facility are:

- Validation only: Credit card processing (which secures deposits at the time of booking).

- Credit card processing: With either option, credit card accounts entered during booking are validated to assure that the account is active and in good standing. The credit card processing option also allows properties to process credit card deposits.

Purpose

When customers complete their shopping cart, their credit card is preauthorized, and the order is entered into Sales Order. Credit Card Processing dials out and obtains a credit card payment. Within five minutes, the customer receives an e-mail receipt.

Scope

- Automatically connects to your financial network for credit card authorizations and settlements.

- Integrates with Sales Order, Accounts Receivable, and e-Business Manager.

- Support for dial-up (modem) connections or secure Internet connections through TCP/IP and SSL.

- Compliant with Visa and Master Card Electronic Commerce Indicator (ECI) regulations.

Definitions, acronyms and the abbreviations

- Authorization service: The issuer of the card creates a revolving account and grants a line of credit to the consumer (or the user) from which the user can borrow money for payment to a merchant or as a cash advance to the user.

- User: One who wishes to use the Credit card.

- CCP: Refers to this Credit Card Processing system.

- HTML: Markup Language used for creating web pages.

- J2EE: Java 2 Enterprise Edition is a programming platform java platform for developing and running distributed java applications.

- HTTP: Hyper Text Transfer Protocol.

- TCP/IP: Transmission Control Protocol/Internet Protocol is the communication protocol used to connect hosts on the Internet.

Technologies to be used

- HTML

- JSP

- JavaScript

- Java

Tools to be used

- Eclipse IDE (Integrated Development Environment)

- Rational Rose tool (for developing UML Patterns)

Overview

SRS includes two sections: overall description and specific requirements.

Overall Description will describe the major role of the system components and inter-connections.

Specific Requirements will describe roles & functions of the actors.

Overall description

Product perspective

This solution involves signing up for a free Business Account. Once this is done and the e-commerce site is properly configured, you can accept payments from Visa, Master Card, Amex, and Discover cards payments.

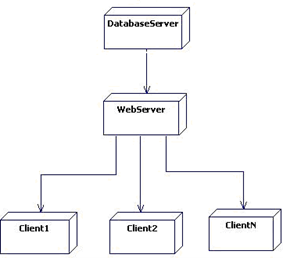

Software interface

- Front End Client: The applicant and Administrator online interface is built using JSP and HTML. The Administrators’ local interfaces are built using Java.

- Web Server: Glassfish application server (SQL Corporation).

- Back End: SQL database.

Hardware interface

The server is directly connected to the client systems. The client systems have access to the database on the server.

System functions

- Accept credit card numbers on the web, store them in the database, then process them offline.

- Credit card processing with CCP.

- Credit card processing with a third-party credit card processor.

User Characteristics

- User /Customer: They are the people who desire to purchase goods using a credit card.

- Authorization Service: Validates the credit card payments to ensure that the card number is valid and the card has not expired.

- Deposit processing: To apply the deposit payment to the card.

- Prepare Credit card transaction reports: That show authorization codes, amounts, and error/success messages.

Constraints

- Trusted if using a well-known third-party processor.

- Must suit higher-volume sites.

- Cheaper transaction rates.

- Getting money transferred may be very fast.

- Must provide fraud prevention measures and fraud protection programs.

Assumptions and dependencies

The Applicants and Administrator must have basic knowledge of computers and the English language. The applicants may be required to scan the documents and send them.

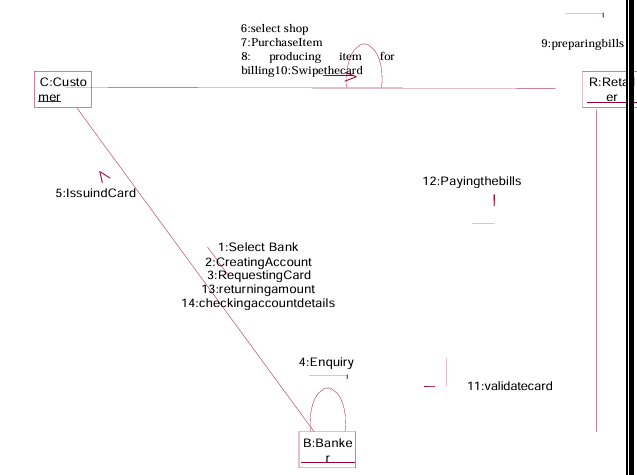

(III) Use Case Diagram:

The Passport Automation system use cases are:

- Creating Account: Used to create an account.

- Credit card request: Used to send the request for a credit card.

- Bank Enquiry: Used to get the bank enquiry like pin code to verify your user account.

- Issuing card: Used to issue the card to the machine.

- Purchase the item: Used to list out the purchase details in the shop.

- Prepare the bill: Used to issue the bill for the purchased item.

- Paying bill: Used to transact money to pay the bill.

Actors involved

- Customer/user: The person who orders the item.

- Banker: The person who checks the account details.

- Retailer: The person preparing the bills.

Use-Case name: Purchase Product

Customer purchases items from the e-commerce site then proceeds to the site’s secure checkout area.

Use-Case name: Authorization Request

Credit card processor collects billing information from the customer via a secure connection.

Use-Case name: Authorization Response

Billing information is verified and the transaction is completed by the credit card issuer.

Use-Case name: Payment Approval

The transaction details are recorded by the credit card processor and results are securely relayed to the merchant. The merchant’s site receives the transaction result and takes appropriate actions (e.g., saves the order & shows a message).

Class Diagram:

The class diagram, also referred to as object modeling, is the main static analysis diagram. The main task of object modeling is to graphically show what each object will do in the problem domain. The problem domain describes the structure and the relationships among objects.

The Credit Card Processing system class diagram consists of three classes:

- Banker

- Customer

- Retailer

Class Diagram For Credit Card Processing

Interaction Diagram:

A sequence diagram represents the sequence and interactions of a given USE-CASE or scenario. Sequence diagrams can capture most of the information about the system. Most object-to-object interactions and operations are considered events, and events include signals, inputs, decisions, interrupts, transitions, and actions to or from users or external devices.

An event is also considered to be any action by an object that sends a message. The event line represents a message sent from one object to another, in which the “from” object is requesting an operation be performed by the “to” object. The “to” object performs the operation using a method that the class defines.

It is also represented by the order in which things occur and how the objects in the system send messages to one another. The sequence diagram for each USE-CASE that exists when a user administrator checks status and new registration about the passport automation system is given.

State chart Diagram:

States of objects are represented as rectangles with rounded corners, indicating the transitions between different states. A transition is a relationship between two states that indicates that when an event occurs, the object moves from the prior state to the subsequent state.

Deployment Diagram and Component Diagram

Deployment diagrams are used to visualize the topology of the physical components of a system where the software components are deployed.

Component diagrams are used to visualize the organization and relationships among components in a system.