Introduction

Balance sheets and profit and loss accounts show the financial status and profitability of a firm respectively. A balance sheet discloses the value of fixed assets and current assets, and the increase or decrease of all assets and liabilities can be ascertained by comparing it with the previous balance sheet. However, it does not disclose the reasons for these changes. To know these reasons, a “Funds Flow Statement” is prepared. In this context, ‘fund’ means “net working capital”.

What is ‘FUND’ and ‘FLOW’?

A layman can describe the word FUND as cash or cash equivalents. In technical terms, the word FUND means ‘Net Working Capital’. Funds may mean:

– Cash only

– Net working capital, i.e., current assets less current liabilities

– Total resources or total funds

– Internal resources only

– Net worth, i.e., owner’s equity capital plus reserves

The term FLOW refers to change or transfer. The term ‘Fund flow’ or ‘Flow of funds’ may thus mean transport of:

– One asset to another

– One liability to another

– Assets to liabilities or vice versa

– The changes in working capital are also an inflow or outflow of funds, and thus it is called fund flow.

“Fund” is considered as working capital while preparing “Funds flow statement”. Fund flow means change in the working capital. In other words, any increase or decrease in working capital means “flow of funds”. Any transaction which has one current account and the other non-current account results in change in the working capital.

Current and Non-current Accounts

Current accounts: Current assets accounts and current liabilities accounts are called current accounts. Assets which are converted into cash within a year are called current assets. Liabilities which are to be paid within a year are called current liabilities.

Non-current account: Accounts which are not current accounts are called non-current accounts. For example, fixed assets accounts, long-term liabilities accounts, and capital & reserves accounts.

Preparation of Funds Flow Statements

Funds flow statement is prepared by observing the items taken place during the periods of two balance sheets along with the adjustments into consideration.

Three statements are to be prepared:

- Statement of Changes in Working Capital

- Statement of Funds from Operations

- Funds Flow Statement

I. Statement of Changes in Working Capital

This statement reveals the net change in the working capital (CA – CL). Current assets and current liabilities are as follows:

Procedure for Preparation

1. The figures of current assets and current liabilities of two balance sheets given are recorded in the respective columns provided. Don’t take the adjustments. Then find working capital and increase/decrease in working capital.

2. By observing the current assets and current liabilities, the differences are shown in the working capital columns against each account and balance those columns. Increase or decrease in working capital can be recognized as follows:

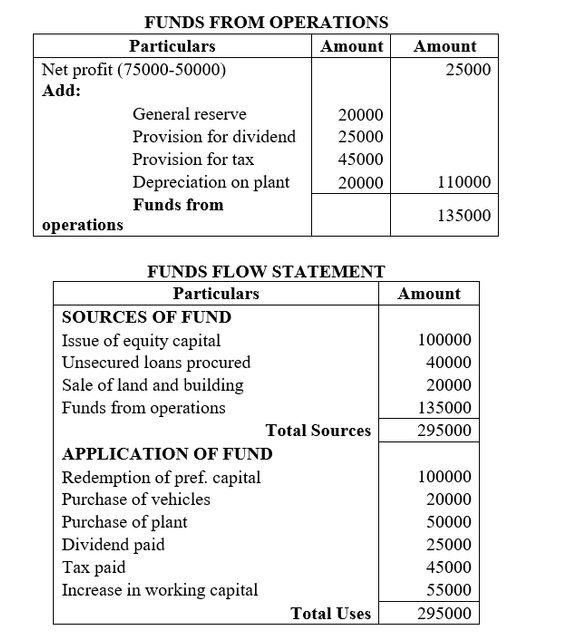

II. Statement of Funds from Operations

Procedure for Preparation

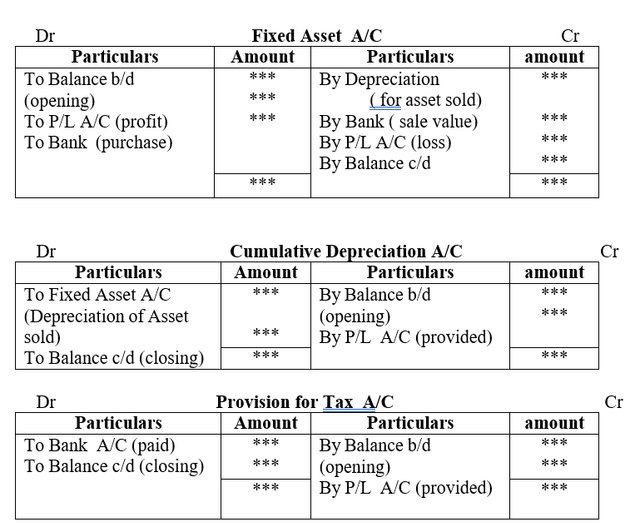

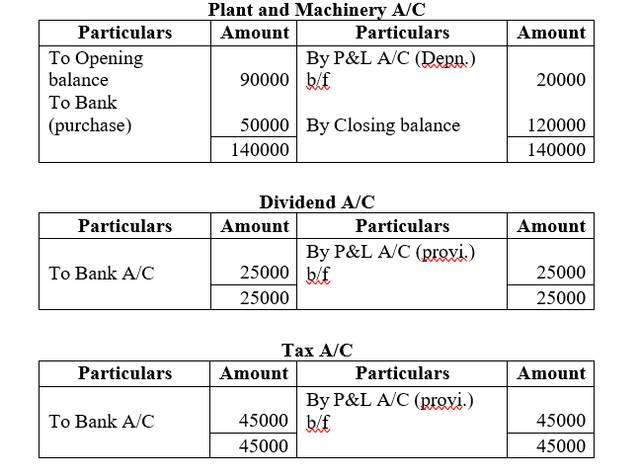

1. Prepare the accounts for the items given in the adjustments to know the hidden information. Generally, the hidden information is as follows:

★ Purchase price of a fixed asset

★ Sale value of a fixed asset

★ Profit/loss on sale of a fixed asset

★ Depreciation provided

★ Depreciation of the asset sold

★ Provision for tax for the year

★ Tax paid during the year

★ Dividend proposed during the year

★ Dividend paid during the year

2. By observing balance sheets and accounts for adjustments, non-operating expenses and non-cash payment items (debit items of profit and loss account) are to be added to given net profit, and all non-operating incomes & non-cash received items (credit items of profit and loss A/C) are to be deducted from given net profit to find the funds from operations.

Note: When tax paid is not given, it is considered that the tax provided in the previous year is paid in the current year.

Note: When dividend paid is not given, it is considered that the dividend proposed in the previous year is paid in the present year.

Note: It can be found even if any one of the items is not given in the above said accounts.

In case provision for tax and proposed dividend are taken as current liabilities, there is no need to prepare those accounts. These should be shown in the “statement of changes in working capital” only.

If these both are taken as an appropriation of profit (unlike current liabilities), there is a need to prepare their accounts to know the hidden information. Provision for tax and proposed dividend are to be added to the net profit to know the funds from operations and tax paid & dividend paid are shown on the applications’ side in the funds flow statement.

III. Funds Flow Statement

Procedure for Preparation

1. By examining the non-current assets and liabilities, show as a source if cash comes and as an application if cash goes out.

2. Show non-operating income as a source and non-operating expenses as an application.

3. Through adjustment items, if cash comes in show as a source and if cash goes out show as an application.

4. If goodwill shows increase, take on the applications’ side.

Note: In order to say in a single sentence, except the items taken in the “statements of changes in working capital and funds from operations”, take as a source when cash comes through all other items and take as an application when cash goes out through all other items.

PRACTICE PROBLEMS

- Prepare

- Statement of Changes in Working Capital

- Funds Flow Statement

from the following balance sheets of Vijaya Mitra Ltd., as on 31-03-2016 and 31-03-2017:

Adjustments:

Dividend declared and paid: Rs. 25,000

Additional plant purchased: Rs. 5,000

Tax paid during the year: Rs. 45,000

Solution:

working notes:

Advantages of Fund Flow Statements

1. Funds flow statement reveals the net result of business operations done by the company during the year.

2. In addition to the balance sheet, it serves as an additional reference for many interested parties like analysts, creditors, suppliers, and the government to look into the financial position of the company.

3. The Fund Flow Statement shows how the funds were raised from various sources and also how those funds were deployed by the company.

4. It reveals the causes for the changes in liabilities and assets between the two balance sheet dates.

5. Funds flow statement helps the management in deciding its future course of plans and also acts as a control tool for the management.

Disadvantages of Fund Flow Statements

1. Funds Flow statement has to be used along with the balance sheet and profit and loss account for inference of financial strengths and weaknesses of a company; it cannot be used alone.

2. Fund Flow Statement does not reveal the cash position of the company, and that is why the company has to prepare a cash flow statement in addition to the funds flow statement.

3. Funds flow statement only rearranges the data which is there in the books of account and therefore it lacks originality.

4. Funds flow statement is basically historic in nature, that is, it indicates what happened in the past and it does not communicate anything about the future; only estimates can be made based on the past data and therefore it cannot be used by the management for taking decisions related to the future.

Cash Flow Analysis

A Cash Flow Statement is a statement showing changes in cash position of the firm from one period to another. It explains the inflows (receipts) and outflows (disbursements) of cash over a period of time. The inflows of cash may occur from sale of goods, sale of assets, receipts from debtors, interest, dividend, rent, issue of new shares and debentures, raising of loans, short-term borrowing, etc. The cash outflows may occur on account of purchase of goods, purchase of assets, payment of loans loss on operations, payment of tax and dividend, etc.

The cash flow statement shows how much cash comes in and goes out of the company over the quarter or the year. At first glance, that sounds a lot like the income statement in that it records financial performance over a specified period. But there is a big difference between the two.

What distinguishes the two is accrual accounting, which is found on the income statement. Accrual accounting requires companies to record revenues and expenses when transactions occur, not when cash is exchanged. At the same time, the income statement, on the other hand, often includes non-cash revenues or expenses, which the statement of cash flows does not include.

Just because the income statement shows net income of Rs.10 does not mean that cash on the balance sheet will increase by Rs.10. Whereas when the bottom of the cash flow statement reads Rs.10 net cash inflow, that’s exactly what it means. The company has Rs.10 more in cash than at the end of the last financial period. You may want to think of net cash from operations as the company’s “true” cash profit.

Because it shows how much actual cash a company has generated, the statement of cash flows is critical to understanding a company’s fundamentals. It shows how the company is able to pay for its operations and future growth.

Indeed, one of the most important features you should look for in a potential investment is the company’s ability to produce cash. Just because a company shows a profit on the income statement doesn’t mean it cannot get into trouble later because of insufficient cash flows. A close examination of the cash flow statement can give investors a better sense of how the company will fare.

Objectives Of Cash Flow Statement

1. Highlighting cash flow from different activities

2. Short-term Planning

3. Cash Flow information helps to understand liquidity

4. Efficient cash management

5. Prediction of sickness

6. Comparison with budget

7. Cash position

Current Assets And Current Liabilities

Current Assets

1. Cash in hand

2. Cash at bank

3. Bills receivables

4. Debtors

5. Short term advances

6. Short term investments

7. Inventories or stock

8. Pre-paid expenses

9. Incomes to be received

10. Loose tools, etc.

Current Liabilities

1. Bills payables

2. Creditors

3. Outstanding expenses

4. Dividends to be paid

5. Bank over draft

6. Short term loans

7. Provisions for current assets (ex: RBD)

8. Taxes to be paid

9. Provision for tax

10. Proposed dividend

The general rules that develop from the above discussion are:

1. An increase in current assets leads to decrease in cash.

2. A decrease in current assets leads to an increase in cash.

3. An increase in current liabilities leads to an increase in cash.

4. A decrease in current liabilities leads to a decrease in cash.

Preparing A Cash Flow Statement

Cash flow statements have three distinct sections, each of which relates to a particular component – operations, investing and financing – of a company’s business activities.

The indirect method of presentation is very popular, because the information required for it is relatively easily assembled from the accounts that a business normally maintains in its chart of accounts. The indirect method is less favoured by the standard-setting bodies, since it does not give a clear view of how cash flows through a business. The alternative reporting method is the direct method.

Three Sections of the Cash Flow Statement

Companies produce and consume cash in different ways, so the cash flow statement is divided into three sections: cash flows from operations, financing and investing. Basically, the sections on operations and financing show how the company gets its cash, while the investing section shows how the company spends its cash.

1. Operating Activities: Operating activities include cash flows from all standard business operations. Cash receipts from selling goods and services represent the inflows. The revenues from interest and dividends are also included here. The operational expenditures are considered as outflows for this section. Although interest expenses fall under this section but the dividends are not included. Dividends are considered as a part of financing activity in financial accounting terms.

2. Investing Activities: Investing activities include transactions with assets, marketable securities and credit instruments. The sale of property, plant and equipment or marketable securities is a cash inflow. Purchasing property, plant and equipment or marketable securities are considered as cash outflows. Loans made to borrowers for long-term use is another cash outflow. Collections from these loans, however, are cash inflows.

3. Financing Activities: Financing activities on the statement of cash flows are much more defined in nature. The receipts come from borrowing money or issuing stock. The outflows occur when a company repays loans, purchases treasury stock or pays dividends to stockholders. As the case with other activities on the statement of cash flows depend on activities rather than actual general ledger accounts.

Procedure for Preparation

1. Prepare accounts for adjustments to find hidden information.

2. Observe balance sheets and accounts for adjustments. Adjust non-cash items, non-operating items, and current assets & current liabilities to net profit except cash and bank balances.

3. Observe all fixed assets and their adjustment accounts. Show purchase and sale of assets.

4. Observe all capital & long-term liabilities and their adjustment accounts. Show capital & loans received and repaid.

Advantages Of Cash Flow Statement

1. It shows the actual cash position available with the company between the two balance sheet dates, which funds flow and profit and loss account are unable to show. So, it is important to make a cash flow report if one wants to know about the liquidity position of the company.

2. It helps the company in accurately projecting the future liquidity position of the company, enabling it to arrange for any shortfall in money by arranging finance in advance. If there is excess, it can help the company in earning extra returns by deploying excess funds.

3. It acts like a filter and is used by many analysts and investors to judge whether the company has prepared the financial statements properly or not. If there is any discrepancy in the cash position as shown by the balance sheet and the cash flow statement, it means that statements are incorrect.

Disadvantages Of Cash Flow Statement

1. Since it shows only the cash position, it is not possible to deduce the actual profit and loss of the company by just looking at this statement.

2. In isolation, this is of no use and it requires other financial statements like balance sheet, profit and loss, etc., and therefore limiting its use.

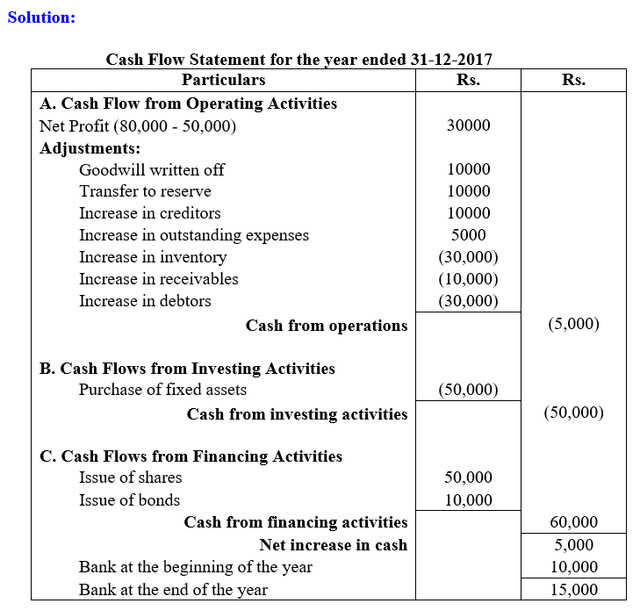

1. From the following balance sheets as on 31-12-2016 and 31-12-2017. You are required to prepare a cash flow statement.