Menu

Preparation of Trial Balance

According to the double entry system, every debit has a corresponding credit. All the debit balances are equal to credit balances. If they don’t agree, it is understood that some mistakes are committed somewhere. A Trial Balance is a statement in which debit and credit balances of all ledger accounts are shown to list the arithmetical accuracy of the books of accounts.

Features of Trial Balance

• It is not an account.

• It contains debit and credit balances of accounts.

• It helps in the preparation of final accounts.

• Both debit and credit sides of a trial balance are always equal.

Format of the Trial Balance

| Particulars | Debit Amount | Particulars | Credit Amount |

| Balances of all assets, Expenses, Losses | xxxx | Balances of all liabilities, Incomes, Gains, Reserves | xxxx |

| Format of the Trial Balance 31st December 202X | |||

|---|---|---|---|

| Debit Balance | Rs | Credit Balance | Rs |

| Debtors | xxxx | Creditors | xxxx |

| All assets | xxxx | All liabilities | xxxx |

| All expenses | xxxx | All incomes and gains | xxxx |

| All losses | xxxx | Profits account | xxxx |

| Purchases | xxxx | Loan account | xxxx |

| Sales returns | xxxx | Bank over draft | xxxx |

| Drawings | xxxx | Sales | xxxx |

| Stock | xxxx | Purchase returns | xxxx |

| Bills receivables | xxxx | Provision for doubtful debts | xxxx |

| Prepaid expenses | xxxx | Provision for discount on debtors | xxxx |

| Incomes receivables | xxxx | All reserves and surpluses | xxxx |

| All intangible assets | xxxx | Bills payables | xxxx |

| Outstanding expenses | xxxx | ||

| Incomes received in advance | xxxx | ||

| Capital | xxxx | ||

| xxxx | xxxx |

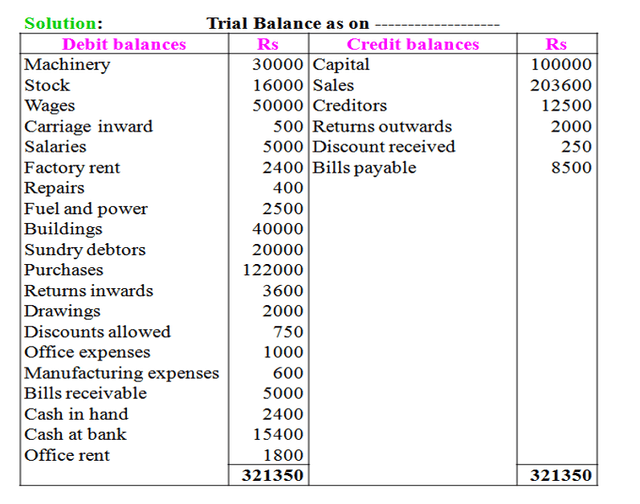

Example:- Make a trial balance from the below balances of accounts.

| Particulars | Rs | Particulars | Rs |

| Capital | 100000 | Machinery | 30000 |

| Stock | 16000 | Wages | 50000 |

| Carriage inward | 500 | Salaries | 5000 |

| Factory rent | 2400 | Repairs | 400 |

| Fuel and power | 2500 | Buildings | 40000 |

| Sundry debtors | 20000 | Sales | 203600 |

| Purchases | 122000 | Creditors | 12500 |

| Returns outwards | 2000 | Returns inwards | 3600 |

| Drawings | 2000 | Discount allowed | 750 |

| Discount received | 250 | Office expenses | 1000 |

| Manufacturing expenses | 600 | Bills payable | 3000 |

| Bills receivable | 5000 | Cash in hand | 2400 |

| Cash at bank | 15400 | Office rent | 1800 |