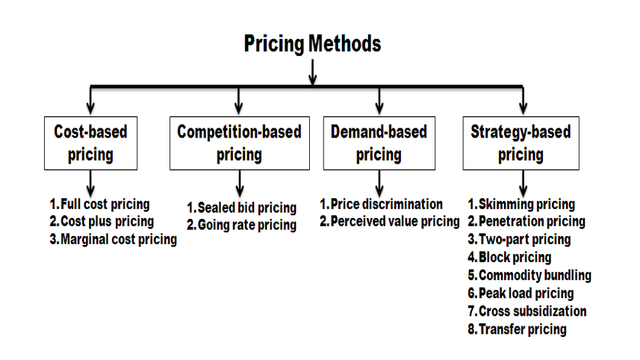

Types of Pricing

Firms set prices for their products through several alternative means. The important pricing methods followed in practice are shown in the chart.

A. Cost-Based Pricing

1. Full Cost Pricing: Under this method, price is just equal to the average cost.

2. Cost Plus Pricing: Here, the average cost is ascertained and then a conventional margin added to the cost to arrive at the price. In other words, find out the product unit’s total cost and add a percentage of profit to arrive at the selling price. It is commonly followed in departmental stores and other retail shops. This method is simple to administer. It may be very difficult to find the selling price in advance due to the complexity of the nature of the project.

3. Marginal Cost Pricing (Break-Even Pricing or Target Profit Pricing): In this method, the selling price is fixed in such a way that it covers full variable or marginal cost and contributes towards the recovery of fixed costs. In stiff competition, marginal cost offers guidelines as to how far the selling price can be lowered.

B. Competition-Based Pricing

Here the price of the product is set based on what the competitor charges for a similar product. In other words, a reduction in the price of products by the competitor will force us to follow suit. In such a case, how far can we go on reducing the price? Here the marginal cost concept comes in handy. As long as the price covers the marginal cost, continue to sell. If not, better stop selling. It is because every unit sold at less than marginal cost results in a loss.

1. Sealed Bid Pricing: This method is more popular in tenders and contracts. Each contracting firm quotes its price in a sealed cover called “tender”. All the tenders are opened on a scheduled date and the person who quotes the lowest price is awarded the contract.

2. Going Rate Pricing: Here the prevailing market price is charged. For instance, when one wants to buy or sell gold, the prevailing market rate at a given point in time is taken as the basis to determine the price.

C. Demand-Based Pricing

1. Perceived Value Pricing: This method considers the buyer’s perception of the value of the product as the basis of pricing. Here the pricing rule is that the firm must develop procedures for measuring the relative value of the product as perceived by consumers.

2. Price Discrimination (Differential Pricing): Price discrimination refers to the practice of charging different prices to customers for the same good. It involves selling a product or service for different prices in different market segments. Price differentiation depends on the geographical location of the consumers, type of consumer, purchasing quantity, season, time of the service, etc. For example, telephone charges, APSRTC charges.

D. Strategy-Based Pricing

1. Skimming Pricing: The company follows this method when the product is introduced to the market for the first time. Under this method, the company fixes a very high price for the product. This strategy is mostly found in the case of technology products. When Samsung introduces a new cell phone model, it fixes a high price because of the uniqueness of the product.

2. Penetration Pricing: This is exactly the opposite of the market skimming method. Here, a low price is fixed for the product in order to catch the attention of consumers. Once the product image and credibility are established, the seller slowly starts jacking up the price to reap good profits in the future. The Rin washing soap perhaps falls into this category. This soap was sold at a rather low price in the beginning and the firm even distributed free samples. Today, it is quite an expensive brand and yet it is selling very well.

3. Two-Part Pricing: Under this strategy, a firm charges a fixed fee for the right to purchase its goods, plus a per-unit charge for each unit purchased. Entertainment houses such as country clubs, athletic clubs, etc., usually adopt this strategy. They charge a fixed initiation fee or membership fee plus a charge, per month or per visit, to use the facilities.

4. Block Pricing: We see block pricing in our day-to-day life very frequently. Four Santhoor soaps in a single pack with a nice-looking soap box or five Maggi packets in a single pack with an attractive bowl indicate this pricing method. The total value of the goods includes consumer surplus as the consumer is given a soap box and bowl along with the products freely. By selling a certain number of units of a product as one package, the firm earns more than by selling unit-wise.

5. Commodity Bundling: Commodity bundling means the practice of bundling two or more different products together and selling them at a single ‘bundle price’. For example, tourist companies offer a package that includes traveling charges, hotel, meals, sightseeing, etc., at a bundle price instead of pricing each of these services separately.

6. Peak Load Pricing: Under this method, a high price is charged during peak times than off-peak times. RTC increases charges during festivals, and railways charge more fares during tatkal time. During the seasonal period when demand is likely to be higher, a firm may increase profits by peak load pricing.

7. Cross Subsidization: The process of charging a high price for one group of customers in order to subsidize another group.

8. Transfer Pricing: Transfer pricing means a price at which one process forwards their output (work-in-progress) to the next process for further processing. It is an internal pricing technique.