- Significance of Economics

- Micro and Macro Economics concepts

- Concepts and importance of National Income

- Inflation

- Money Supply And Inflation

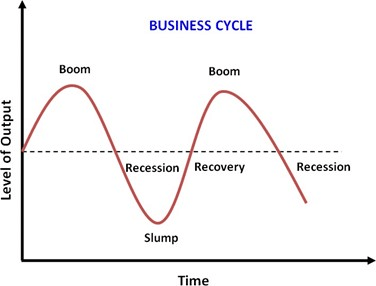

- Business Cycle

- Features and phases Of A Business Cycle

- Nature and scope Of Business Economics

- The Role Of Business Economist

- Multi-Disciplinary Nature Of Business Economics

Features Of A Business Cycle

1. Cyclical movements: When excess movement in one direction, say depression, tends to bring into operations not only its remedy but also a stimulus to an excess movement in the other direction, say boom, the movement is said to be cyclical. It is like the movement of a pendulum. The movement in one direction tends to automatically generate a movement in the opposite direction of prosperity in the economy, sowing the seeds of depression as well.

2. International in nature: It is very likely that a boom in the economy of one country will lead to a boom in another country. Different countries are linked with one another through international trade and foreign exchange. This implies that prosperity in one country contributes to prosperity in other countries as well.

3. Varying degree of impact: Since periods of business cycles are more likely to be different, they tend to vary in the degree of their impact on an economy. Business cycles may affect different industries in an economy to varying degrees.

4. Irregular patterns: No two business cycles are similar in rhythm. There is no fixed pattern governing each business cycle.

5. Wave-like movement: Business cycles reflect a wave-like movement that implies a composite photograph of all the recorded cycles. One complete round from boom to depression and depression to boom is called a business cycle.

6. Fluctuation in productive capacities: Production capacities undergo wild fluctuations measured in terms of unemployment.

7. Fluctuations in price levels: The upward phase of the cycle is identified with the expansion of production capacities, diminishing unemployment, and a rise in prices. On the other hand, the downward phase of the cycle is identified with the contraction of production capacities, increasing unemployment, and a fall in prices.

8. Every cycle has four distinct phases: (a) depression, (b) revival, (c) prosperity or boom, and (d) recession.

Phases Of A Business Cycle

(a) Prosperity/Expansion/Boom: In this stage, there is increased production, high capital investment in basic industries, expansion of bank credit, high prices, high profit, and full employment.

(b) Recession: This stage is characterized by liquidation in the stock market, strain in the banking system and some liquidation of bank loans, a small fall in prices, a sharp reduction in demand for capital equipment, and the abandonment of relatively new projects. Unemployment leads to reduced income, expenditure, prices, and profits. It is a cumulative effect; once a recession starts, it goes on gathering momentum and finally assumes the shape of depression.

(c) Depression/Slump: It is a period in which business activities in the country are far below normal. It is characterized by a sharp reduction in production, mass unemployment, low employment, falling prices, falling profits, low wages, contraction of credit, a high rate of business failures, and an atmosphere of all-round pessimism and despair. All construction activities come to a more or less complete standstill during a depression. The consumer goods industries, however, are not much affected.

(d) Recovery: It implies an increase in business activity after the lowest point of depression has been reached. Entrepreneurs begin to feel that the economic situation is not so bad after all. This leads to new innovations in business activities. Industrial production picks up slowly and gradually. The volume of employment also steadily increases. There is a slow rise in prices accompanied by a small rise in profits. Wages also rise, and new investment takes place in capital goods industries. The banks also expand credit. Pessimism is gradually replaced by an atmosphere of cautious hope.