Accounting Equation

The basic accounting equation, also called the balance sheet equation, represents the relationship between the assets, liabilities, and owner’s equity of a business. It is the foundation for the double-entry bookkeeping system. For each transaction, the total debits equal the total credits. It can be expressed as:

Assets = Liabilities + Equity

In a company, capital represents the shareholders’ equity. Since every business transaction affects at least two of a company’s accounts, the accounting equation will always be “in balance,” meaning the left side should always equal the right side. Thus, the accounting formula essentially shows that what the firm owns (its assets) is purchased by either what it owes (its liabilities) or by what its owners invest (its shareholders’ equity or capital).

For example: A student buys a computer for Rs.1000. To pay for the computer, the student uses Rs.400 in cash and borrows Rs.600 for the remainder. Now his assets are worth Rs.1000, liabilities are Rs.600, and equity Rs.400.

The formula can be rewritten as:

Assets – Liabilities = (Shareholders’ or Owners’ Equity)

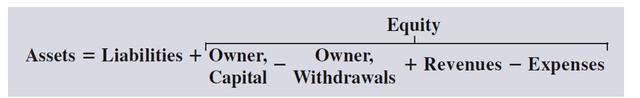

Sometimes we expand the Accounting Equation to show all the Equity components. This is called the Expanded Accounting Equation.

Now it shows owners’ interest is equal to property (assets) minus debts (liabilities). Since in a company, owners are shareholders, the owner’s interest is called shareholders’ equity. Every accounting transaction affects at least one element of the equation, but always balances. Simplest transactions also include:

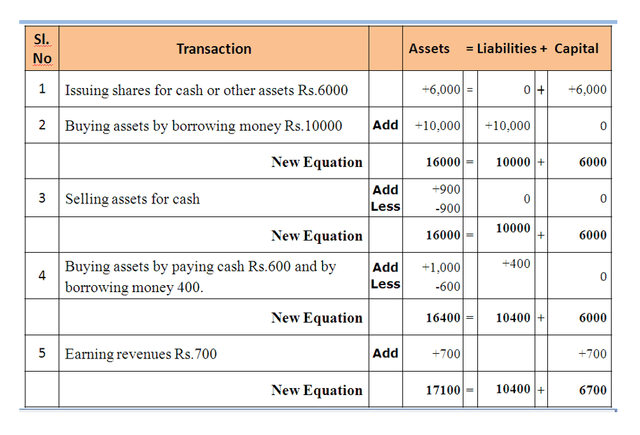

Example 1: Prepare the Accounting Equation on the basis of the following:

- Issuing shares for cash or other assets Rs.6000

- Buying assets by borrowing money Rs.10000

- Selling assets for cash Rs.900

- Buying assets by paying cash Rs.600 and by borrowing money Rs.400

- Earning revenues Rs.700