Journal

The first step in accounting therefore is the record of all the transactions in the books of original entry viz., Journal and then posting into ledgers.

The word Journal is derived from the Latin word ‘journ’ which means a day. Therefore, journal means a ‘day Book’ in day-to-day business transactions are recorded in chronological order.

Journal is treated as the book of original entry or first entry or prime entry. All the business transactions are recorded in this book before they are posted in the ledgers. The journal is a complete and chronological (in order of dates) record of business transactions. It is recorded in a systematic manner. The process of recording a transaction in the journal is called “JOURNALISING”. The entries made in the book are called “Journal Entries”.

The proforma of Journal is given below.

Proforma of Journal

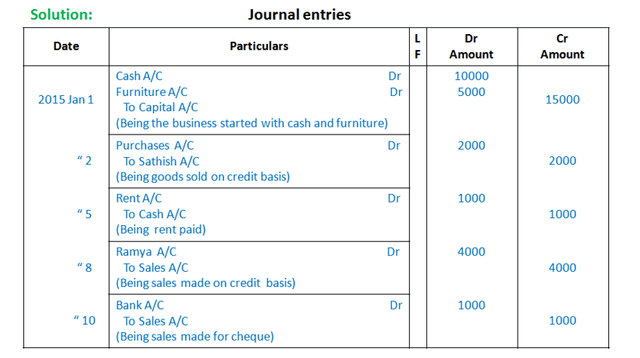

2015

Jan 1: Business started with Rs. 10,000 Cash and Furniture Rs. 5,000

Jan 2: Goods purchased from Mr. Sathish Rs. 2,000

Jan 5: Rent paid Rs. 1,000

Jan 8: Goods sold to Mr. Ramya Rs. 4,000

Jan 10: Goods sold and cheque received Rs. 1,000

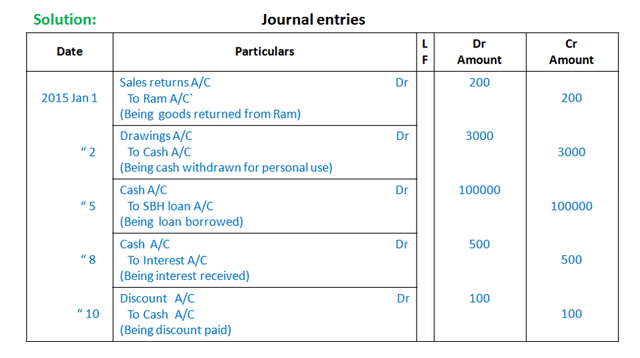

2015

Jan 1: Goods returned from Ram Rs. 200

Jan 2: Cash withdrawn for personal use Rs. 3,000

Jan 5: Loan borrowed from SBH Rs. 100,000

Jan 8: Interest received Rs. 500

Jan 10: Discount paid Rs. 100

Subdivision of Journal

Small businesses record all transactions in a single journal, but large companies record their transactions in different journals according to their nature. The journal is sub-divided into eight parts. They are:

1. Purchase book: Where all credit purchases are recorded.

2. Sales book: Where all credit sales are recorded.

3. Purchase returns book: Where the particulars of goods returned to suppliers are recorded.

4. Sales returns book: Where the particulars of goods returned from customers are recorded.

5. Bills receivable book: Where the details of bills received are recorded.

6. Bills payable book: Where the details of bills payable are recorded.

7. Cash book: Where all the cash transactions are recorded.

8. Proper journal: Where the transactions which are not recorded in the above books are recorded.

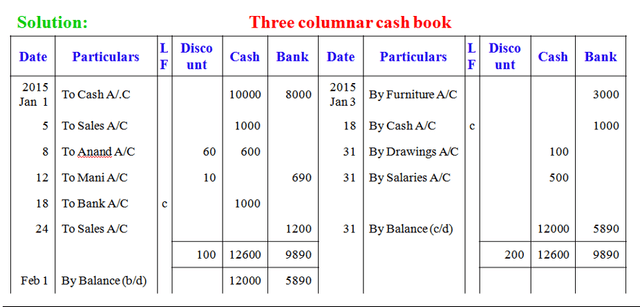

2015

Jan 1: Manmohan started a business with cash balance of Rs. 10,000 and paid into bank Rs. 8,000

Jan 3: Bought office furniture by cheque Rs. 3,000

Jan 5: Sold goods for cash Rs. 1,000

Jan 8: Anand paid Rs. 600 and was allowed a discount of Rs. 60

Jan 12: A cheque received from Mani for Rs. 690 and allowed him a discount of Rs. 10; the cheque was deposited into bank

Jan 18: Cash withdrawn from bank for office use Rs. 1,000

Jan 24: Received a cheque for sales Rs. 1,200

Jan 20: Drew cash for personal use Rs. 100; Salaries paid Rs. 500