- Significance of Economics

- Micro and Macro Economics concepts

- Concepts and importance of National Income

- Inflation

- Money Supply And Inflation

- Business Cycle

- Features and phases Of A Business Cycle

- Nature and scope Of Business Economics

- The Role Of Business Economist

- Multi-Disciplinary Nature Of Business Economics

National Income

In every country goods and services are produced in agriculture sector, industrial sector and service sector. The total value of final goods and services produced in a country in a year is called national income. National income was first calculated in India by Dadabai Noaroji in 1876. In our country national income is calculated every year by Central Statistical Organization (CSO). It includes payments made to all resources in the form of wages, interest, rent and profits.

According to Marshall: ―The labour and capital of a country acting on its natural resources produce annually a certain net aggregate of commodities, material and immaterial including services of all kinds. This is the true net annual income or revenue of the country or national dividend.‖ In this definition, the word ‗net‘ refers to deductions from the gross national income in respect of depreciation and wearing out of machines. And to this, must be added income from abroad.

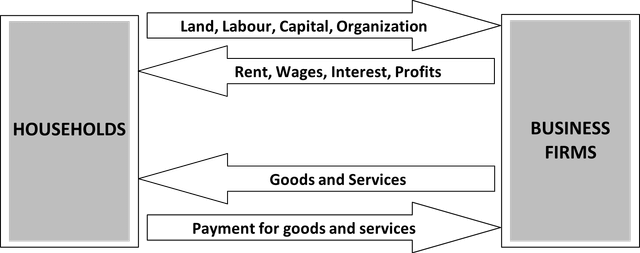

Circular Flow of National Income

National income is a flow of money payments resulting from the productive resources of a country during a year. It has the concept of circular flow in this sense that the economic transactions which are made in a country during a particular year appears in different ways. The expenditure of one person is the income of another person, and his expenditure is also equal to value of goods and services. To explain this idea we assume that there is economy where are only two sectors in the economy.

1. Firms.

2. Households.

Firms are required to produce goods. Households own the various factors of production. Firms require the services of households to produce goods. The firms hire the services of households to produce goods. These goods are again supplied to the households. When households sector purchases the goods it makes the payments. Similarly firms make the payment in the shape of rent, wages, and interest to the households against their services.

In this way the sum of prices of the goods and services must be equal to the sum of the reward for the services of factors of production.

So income flows from firms to households in exchange for these services and again the expenditure flows from households to firms. The goods which are produced by the firms these are purchased by the household. The flow of income flows from firms to household and flow of expenditure from household to firms will be equal. This is called circular flow of national income.

National income can be calculated on the basis of:

1. Flow of goods and services

2. Flow of income

3.Flow of expenditure on goods and services

Concepts Of National Income

There are various concepts of National Income. The main concepts of NI are: GDP, GNP, NNP, NI, PI, DI, and PCI. These different concepts explain about the phenomenon of economic activities of the various sectors of the economy.

1. Gross Domestic Product (GDP)

Gross domestic product – the market value of all final goods and services produced in a country during a specific period of time which is usually one year.

GDP is measured using market values, and not quantities. Production is measured in quantities, but then those quantities have to be changed to account for their value. In economics we use prices to place values on the final goods, so total production times price will give us the total value.

Final goods and services vs intermediate goods or services. A product is a final good or service when it is purchased by the final user. Intermediate products are used as an input to produce another good or service such as sugar being purchased to make soda. Sugar is an intermediate good, while soda is a final good.

GDP only includes the value of final goods, intermediate goods are not included. GDP only includes current production, and ignores the sale of used goods. If you purchase a bike in 2011, then that purchase is included in 2011 GDP measure, not 2010 or 2012. Also, if you sell that bike at any time in the future, the sale of that bike is not included in GDP.

An equation for GDP and some actual values:

GDP = C + I + G + NX

The GDP equation shows us that GDP is equal to consumption expenditure (C) plus investment expenditure (I) plus government expenditure (G) plus net exports (NX = Exports – Imports).

2. Gross National Product (GNP)

Gross National Product is the total market value of all final goods and services produced annually in a country plus net factor income from abroad. Thus, GNP is the total measure of the flow of goods and services at market value resulting from current production during a year in a country including net factor income from abroad. The GNP can be expressed as the following equation:

GNP = GDP + NFIA (Net Factor Income from Abroad)

NFIA = Income earned by Indians in abroad through jobs or businesses – Income earned by foreigners in India by jobs or businesses.

3. Net National Product (NNP)

Net National Product is the market value of all final goods and services after allowing for depreciation. It is also called National Income at market price. When charges for depreciation are deducted from the gross national product, we get it. Thus,

NNP = GNP – Depreciation

4. National Income (NI)

National Income is also known as National Income at factor cost. National income at factor cost means the sum of all incomes earned by resources suppliers for their contribution of land, labor, capital and organizational ability which go into the years net production. Hence, the sum of the income received by factors of production in the form of rent, wages, interest and profit is called National Income. Symbolically,

NI = NNP + Subsidies given by Govt. – Indirect Taxes

5. Personal Income (PI)

Personal Income is the total money income received by individuals and households of a country from all possible sources before direct taxes. Therefore, personal income can be expressed as follows:

PI = NI – Corporate Income Taxes – Undistributed Corporate Profits – Social Security Contribution + Transfer Payments

6. Disposable Income (DI)

The income left after the payment of direct taxes from personal income is called Disposable Income. Disposable income means actual income which can be spent on consumption by individuals and families. Thus, it can be expressed as:

DI = PI – Direct Taxes

7. Per Capita Income (PCI)

Per Capita Income (average income) of a country is derived by dividing the national income of the country by the total population of a country. Thus,

PCI = Total National Income / Total National Population

Importance Of National Income

The following points highlight the top eleven reasons for growing importance of national income studies in recent years.

1. Economic Policy:

Economic policy refers to the actions which Govt. Takes in the economic field such as Tax policy, Money supply policy, Interest rate policy etc. National income figures are an important tool of macroeconomic analysis and policy.

National income estimates are the most comprehensive measures of aggregate economic activity in an economy. It is through such estimates that we know the aggregate yield of the economy and can lay down future economic policy for development.

2. Economic Planning:

National income statistics are the most important tools for long-term and short-term economic planning. A country cannot possibly frame a plan without having a prior knowledge of the trends in national income. The Planning Commission in India also kept in view the national income estimates before formulating the five-year plans.

3. Economy‟s Structure:

National income statistics enable us to have clear idea about the structure of the economy. It enables us to know the relative importance of the various sectors of the economy and their contribution towards national income. From these studies we learn how income is produced, how it is distributed, how much is spent, saved or taxed.

4. Inflationary and Deflationary Gaps:

Inflationary gap means the amount by which the total demand is higher than the total supply. Deflationary gap means the amount by which the total demand is less than the total supply. National income and national product figures enable us to have an idea of the inflationary and deflationary gaps. For accurate and timely anti-inflationary and deflationary policies, we need regular estimates of national income.

5. Budgetary Policies:

Modern governments try to prepare their budgets within the framework of national income data and try to formulate anti-cyclical policies according to the facts revealed by the national income estimates. Even the taxation and borrowing policies are so framed as to avoid fluctuations in national income.

6. National Expenditure:

National income studies show how national expenditure is divided between consumption expenditure and investment expenditure. It enables us to provide for reasonable depreciation to maintain the capital stock of a community. Too liberal allowance of depreciation may prove harmful as it may unnecessarily lead to a reduction in consumption.

7. Distribution of Grants-in-aid:

National income estimates help a fair distribution of grants-in-aid by the federal governments to the state governments and other constituent units.

8. Standard of Living Comparison:

National income studies help us to compare the standards of living of people in different countries and of people living in the same country at different times.

9. International Sphere:

National income studies are important even in the international sphere as these estimates not only help us to fix the burden of international payments equitably amongst different nations but also enable us to determine the subscriptions and quotas of different countries to international organisations like the UNO, IMF, IBRD, etc.

10. Defense and Development:

National income estimates help us to divide the national product between defence and development purposes. From such figures we can easily know how much can be spared for war by the civilian population.

11. Public Sector:

National income figures enable us to know the relative roles of public and private sectors in the economy. If most of the activities are performed by the state, we can easily conclude that public sector is playing a dominant role.